By the Numbers: 13 April 2020

200,000+

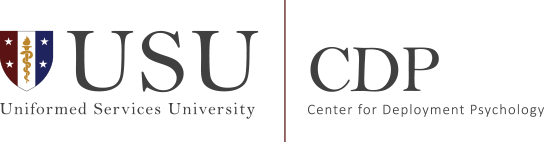

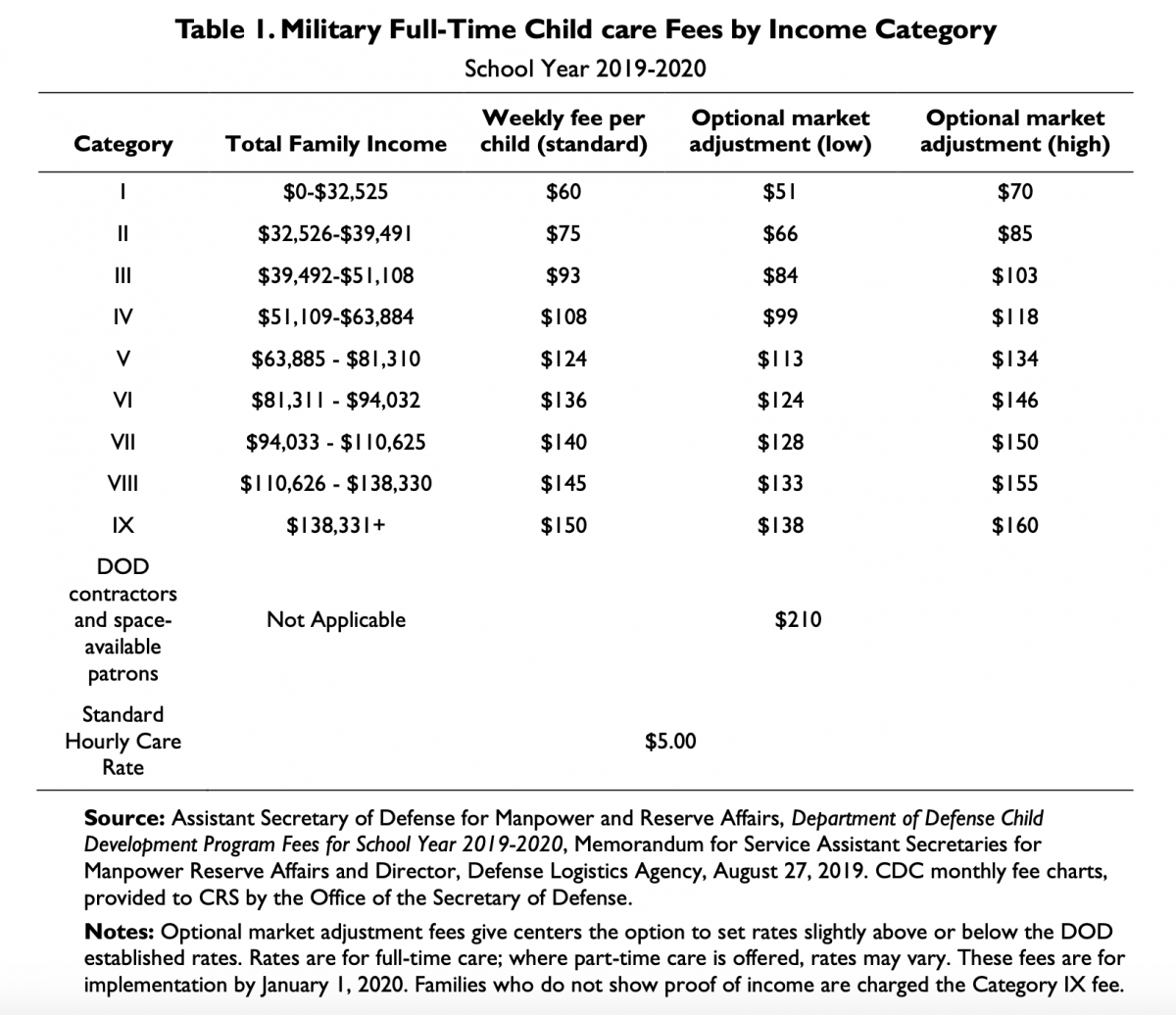

The number of children of "uniformed servicemembers and DOD civilians" served by the DOD child care program, according to a recent report from the Congressional Research Service -- Military Child Development Program: Background and Issues. This DOD program, which employs 23,000+ child care workers at an annual cost of more than $1 billion, is "the largest employer-sponsored child care program in the United States." The report says, "Military child care fees are generally lower than fees for civilian center-based care."

The U.S. Department of Health and Human Services has established a benchmark for affordable child care at 7% of family income for low-income families. To put the military child care fees in context, regular military compensation (including pay, allowances and tax advantage) for an E-5 with one dependent child is $68,093 annually, using the calendar 2019 enlisted pay scale. This pay rate would place the E-5 (with no spousal or other source of income) in income Category V. Therefore, an E-5 would be paying approximately 9.4% of his or her income for child care fees for one child under the standard fee structure. A similarly situated officer, O-3, would have average pay and allowances of $106,825 annually and would be eligible for income category VII. This servicemember (with no spousal or other source of income) would be paying approximately 6.8% of his or her income in child care fees for one child.

200,000+

The number of children of "uniformed servicemembers and DOD civilians" served by the DOD child care program, according to a recent report from the Congressional Research Service -- Military Child Development Program: Background and Issues. This DOD program, which employs 23,000+ child care workers at an annual cost of more than $1 billion, is "the largest employer-sponsored child care program in the United States." The report says, "Military child care fees are generally lower than fees for civilian center-based care."

The U.S. Department of Health and Human Services has established a benchmark for affordable child care at 7% of family income for low-income families. To put the military child care fees in context, regular military compensation (including pay, allowances and tax advantage) for an E-5 with one dependent child is $68,093 annually, using the calendar 2019 enlisted pay scale. This pay rate would place the E-5 (with no spousal or other source of income) in income Category V. Therefore, an E-5 would be paying approximately 9.4% of his or her income for child care fees for one child under the standard fee structure. A similarly situated officer, O-3, would have average pay and allowances of $106,825 annually and would be eligible for income category VII. This servicemember (with no spousal or other source of income) would be paying approximately 6.8% of his or her income in child care fees for one child.