By the Numbers: 8 June 2020

78%

The percentage by which Active Duty Service members "are more likely than other adults to report that an identity thief misused an existing account, such as a bank account or credit card," according to a recent Data Spotlight report from the Federal Trade Commission -- Identity theft causing outsized harm to our troops.

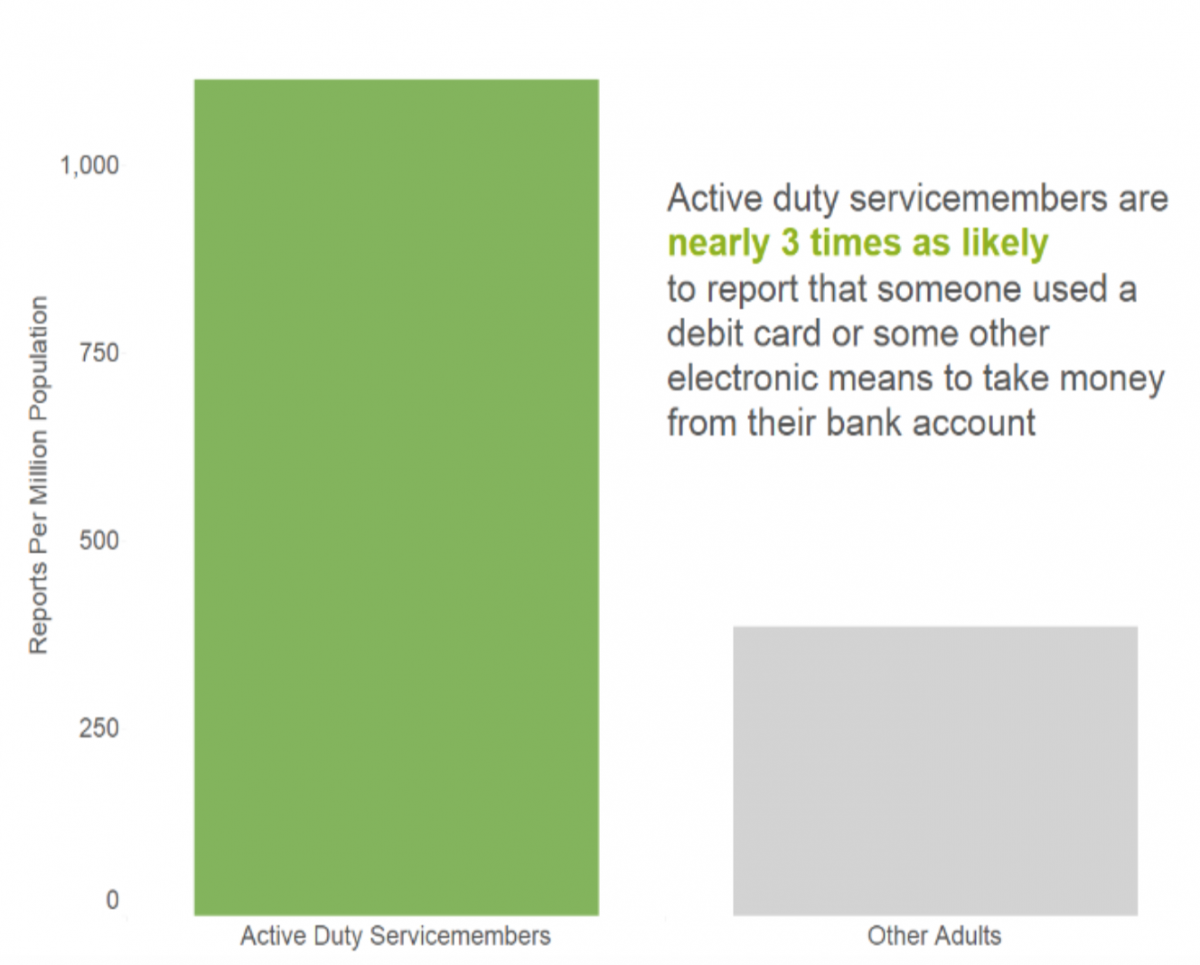

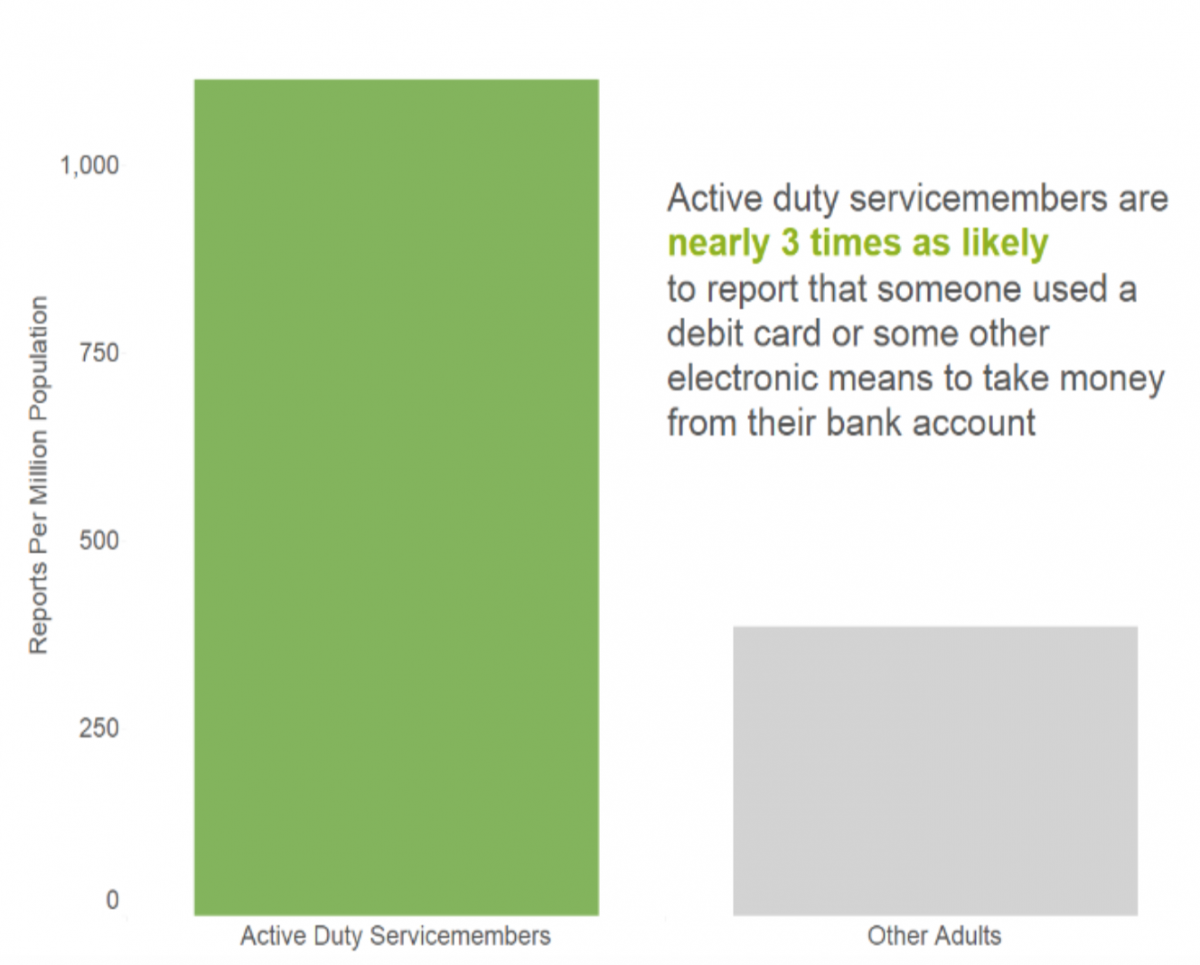

Most notably, they are nearly three times as likely to report that someone used a debit card or some other electronic means to take money directly from their bank account. This finding suggests that servicemembers are experiencing highly disproportionate instances of theft from their financial accounts compared to the general population. That’s not all. They also are 22% more likely to report that their stolen information was misused to open a new account, especially new credit card accounts.

78%

The percentage by which Active Duty Service members "are more likely than other adults to report that an identity thief misused an existing account, such as a bank account or credit card," according to a recent Data Spotlight report from the Federal Trade Commission -- Identity theft causing outsized harm to our troops.

Most notably, they are nearly three times as likely to report that someone used a debit card or some other electronic means to take money directly from their bank account. This finding suggests that servicemembers are experiencing highly disproportionate instances of theft from their financial accounts compared to the general population. That’s not all. They also are 22% more likely to report that their stolen information was misused to open a new account, especially new credit card accounts.